| Unit | 2013 | 2014 | 2015 | Rates of Change over 2014 | |

|---|---|---|---|---|---|

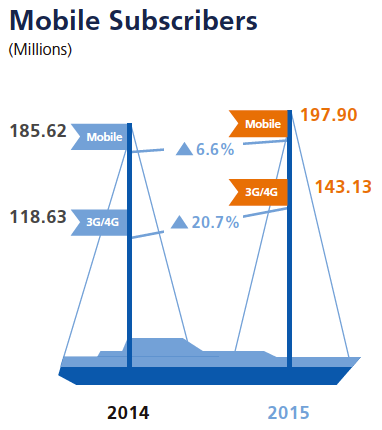

| Mobile subscribers | Million | 185.58 | 185.62 | 197.90 | 6.6% |

| Of which: 3G/4G subscribers | Million | 103.11 | 118.63 | 143.13 | 20.7% |

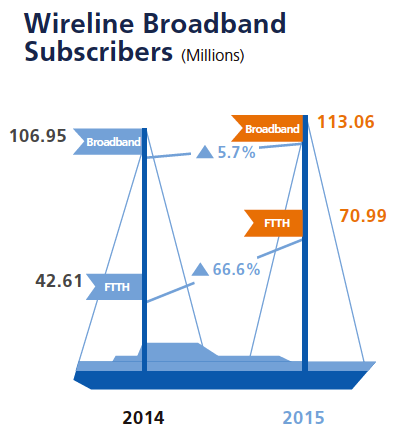

| Wireline broadband subscribers | Million | 100.10 | 106.95 | 113.06 | 5.7% |

| Access lines in service | Million | 155.80 | 143.56 | 134.32 | (6.4%) |

| Mobile voice usage | Million minutes | 603,616 | 655,939 | 667,535 | 1.8% |

| Mobile SMS usage | Million messages | 64,235 | 64,583 | 56,817 | (12.0%) |

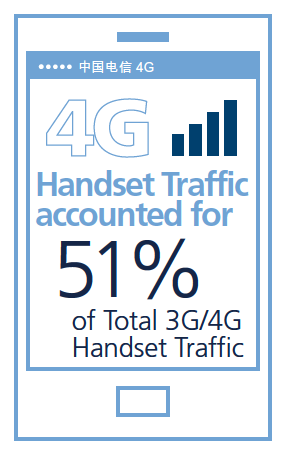

| 3G/4G Handset data traffic | kTB | 175.1 | 266.6 | 554.7 | 108.1% |

| Wireline local voice usage | Million pulses | 148,690 | 130,439 | 110,935 | (15.0%) |

In 2015, the Company proactively implemented initiatives to respond to challenges brought by the changes in regulatory policies and business environment. While firmly promoting the transformation of fundamental business, the Company also vigorously developed its emerging business, maintaining the overall business with stable growth momentum and rapid growth in subscriber base. The Company achieved industry-leading growth in terms of service revenues and continuously optimised its revenue structure. Corporate competitiveness has been significantly strengthened.

Key operating performance

(1) Solid growth in operating revenues and continuous optimisation of business structure

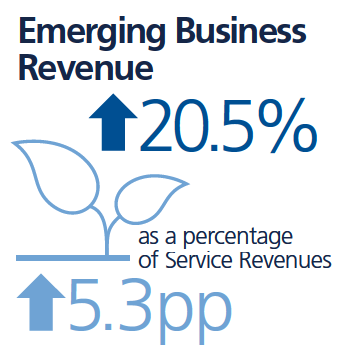

In 2015, the Company’s operating revenues increased by 2.1% to RMB331,202 million. Service revenues increased by 2.0% to RMB293,266 million. The Company’s service revenue structure was further optimised, with mobile service revenues accounting for 42.5% and revenues of emerging business accounting for 34.4%, up 5.3 percentage points.

(2) Rapid growth in mobile services with remarkable contribution from data traffic operations

In 2015, following the FDD 4G licensing, the Company focused on developing its 4G services, accelerated network construction and deployed 4G+ in key areas. Persisted in the terminal-led approach, the Company strongly promoted 4G+ and signature terminals. Strengthened in content application-driven approach, the Company created differentiated core applications. Mobile subscribers rapidly expanded with a steady growth in revenues. The scale of mobile subscribers reached 197.90 million, with a net addition of 12.28 million. Mobile service revenues increased by 3.5% over last year amounting to RMB124,503 million.

The Company has acted proactively to reduce the impact from “Speed Upgrade & Tariff Reduction”. It leveraged Big Data to perform multidimensional analysis on consumer behavior characteristics to optimise its product design and promote efficiently-centralised data traffic packages based on 4G service plans. Data backward monetisation also achieved remarkable results with revenues grew over 5 times. In 2015, 3G/4G handset data traffic reached 555 kTB, an increase of 108.1% year-on-year, while 3G/4G monthly average mobile data traffic per subscriber reached 386MB. Handset data traffic revenue accounted for 38.4% of mobile service revenues, an increase of 10.0 percentage points over last year.

(3) Wireline services development remained solid, with marketleading position maintained in broadband

In 2015, the Company proactively promoted the transformation of fundamental business. Deepening the integration between wireline and mobile services, the Company created competitive edge in new integrated development. With strengthened operations of existing customers, the Company stabilised the foundation of revenues from wireline services. Wireline revenues reached RMB168,763 million, representing an increase of 1.0%.

On broadband services development front, the Company accelerated fibre upgrade for its broadband networks and promoted the end-toend bandwidth upgrade. With focus on promoting high-speed broadband products, the Company has lifted competition barrier to enhance its competitiveness and leading position in the broadband market. In 2015, revenues of wireline broadband increased by 1.1% to RMB74,285 million. Wireline broadband subscribers reached 113.06 million, a net addition of 6.11 million.

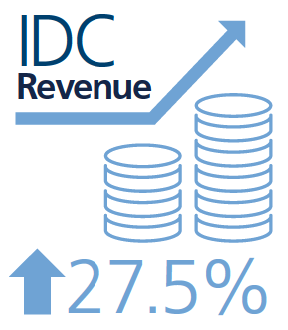

For the development of wireline value-added services (VAS) and integrated information services, the Company continued its promotion in three rapidly growing businesses including IPTV (e-Surfing HD), IT Services & Applications and IDC, driving steady development of its overall business. In 2015, revenues of wireline VAS and integrated information services increased by 10.5% year-on-year to RMB42,035 million. With the foundation of continued enrichment of its video services, the Company actively developed Smart Family applications such as home surveillance. It also expanded the scale of informatisation products for sectors, especially in administration, education, healthcare and etc., and advanced in the transformation from ICT to IIT (Information Internet-ware Technology). The Company focused on efficiently-centralised development of cloud computing products such as cloud hosting and private cloud with strengthening research & development and sales & marketing while accelerated the construction of the unified operating system for IDC.

In 2015, the Company continued to promote integrated development among retail customers. While for government and enterprise market, the Company provided customised solutions to realise value transfer of the wireline voice services, effectively mitigated its operational risk while further declining revenue share of wireline voice services. Revenues from wireline voice services was RMB29,610 million, accounting for 10.1% of the service revenues, representing a reduction of 1.6 percentage points over last year.

Business operating strategies

In 2015, the Company persisted in focusing on differentiation as its work principle and further transformed its development model. With the creation of new competitive edges, the Company accelerated the scale development of subscriber base and enhanced operating capabilities. Six operational measures were deeply implemented:

First, with innovative development models, 4G subscriber scale achieved rapid breakthrough

In 2015, the Company launched 4G handset services across the entire network, continued development effort in both existing customer upgrade as well as new customer acquisition to increase its 4G subscriber penetration rate. In the existing customer market, the Company focused on promoting upgrade of its current 3G subscribers to 4G. In the new customer market, the Company focused on differentiated applications, attracting new customers through “4G + Application”. The Company also reinforced its effort in new customer acquisition in open market to grab its market share. As at the end of 2015, 4G subscribers reached 58.46 million, accounting for 29.5% of mobile subscribers. 4G DOU reached 751 MB, almost twice of 3G/4G subscribers, driving rapid growth in both the scale and revenue of data traffic.

Second, accelerated development of fibre broadband subscribers to reinforce market leadership in wireline broadband services

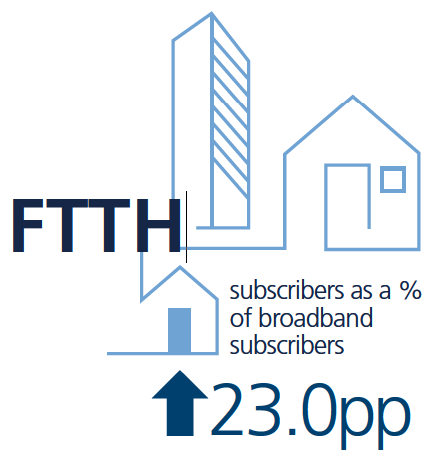

In 2015, led by the 100Mbps broadband service development, the Company focused promotion on 50/100Mbps broadband products. The Company accelerated integration of marketing and maintenance in broadband services by optimising installation process, achieving instant installation upon the completion of sales. Through enriching the content of video-type applications, the Company expanded its smart family products including Smart Gateway and Smart Family. By promoting the sales of newly integrated “Fibre Broadband + e-Surfing HD + 4G” product, the Company successfully drove the mutual sales and development among different products. In 2015, fibre-to-the-home (FTTH) subscribers reached 70.99 million, accounting for 62.8% of broadband subscribers. Subscribers of 20Mbps and above accounted for 44.6%, an increase of 27.4 percentage points over last year.

Third, persisted in the invigoration of industry value chain to enrich 4G handsets

The company implemented “the Excellent 100” programme, to encourage handset manufacturers to produce popular 4G handsets that are compatible with China Telecom’s network, in turn enriched 4G handset portfolio. In 2015, there were 201 new models of 4G terminals. Sales of 4G terminals was close to 62 million, accounting for 70% of total terminal sales. The Company made every effort to promote “Six-Mode Handsets” to become the national standard and strengthened the penetration of its mobile phone cards in the open market to grab a share of the handset replacement market of existing customers. Via deepening cooperation with mainstream handset manufacturers including Huawei, OPPO, Vivo, Xiaomi and MEIZU, the Company implemented resources exchange and increased handset sales volume. Targeting at different segmented market, the Company promoted signature handsets such as security handsets, video handsets and Taobao handsets to cater the differentiated demand of customers. Unifying launch of star handsets such as iPhone, sales volume of high-end terminals recorded a remarkable increase.

Fourth, reinforced efforts to develop ICT and drove subscriber scale development

In 2015, seizing the opportunity brought about by “Internet+”, the Company took the lead in the industry to release the “‘Internet+’ action white paper”, integrating its advantages of cloud, network and safety to refine products, operations, and support system. Upgraded specialised applications in specific sectors including education, transportation and agriculture, the Company created products such as “e-Surfing School” for tens of millions users and “Nongjibao” for millions users. Targeting at industries including administration, manufacturing, finance and healthcare, the Company explored development potentials for cloud-network integration and developed over a thousand of service projects such as government administrative cloud, industrial cloud, financial cloud and video streaming cloud.

Fifth, promoted Internet-oriented transformation of channels to improve sales & marketing efficiency

The Company fully commenced O2O operations. With optimised and coordinated mechanism of physical, government and enterprise and electronic channels, the Company improved the sales and service efficiency by strengthening traffic flow in online channels and user experience in offline channels. In physical channels, the Company carried out “Collaboration with Strong Partners” and “e-Surfing Recommended” promotions, resulted in significant increase in market share of terminal sales and mobile phone card sales in open channels. In government and enterprise channels, the Company implemented the “Sales Elite” programme, which established mini stores for industrial clients, WeChat stores for commercial clients and campus clients and resulted in rapid expansion of our subscriber scale.

In electronic channels, the Company reinforced its position as the main channel for data traffic sales, with the sales volume of 4G data traffic packages accounting for 76%.

Sixth, collaborative operations between online and offline channels to improve customer service capabilities

In 2015, the Company focused on improving capabilities in 4G and fibre broadband services. Focusing on 4G services, the Company implemented “Five Optimised Services” in areas including network experience, products, channel sales, terminal services and customer care. The Company carried out 4G services experience activities nationwide, with continued optimisation in services including 4G data traffic alert, billing and credit control. In respect of wireline broadband services, the Company implemented service guarantee for “Speed Upgrade & Tariff Reduction”. Customers were invited to experience for speed testing and service quality supervision. The Company clearly stated the rules and requirements for indication of upload and download speed. The Company also promoted broadband selfserviced troubleshooting and “Pay after Installation” broadband services. In 2015, the Company ranked No. 1 in the industry in terms of customer satisfaction in both wireline and mobile Internet access services as assessed by the Ministry of Industry and Information Technology. In respect of the Internet-oriented service transformation, the Company achieved the “Double 60” goal, for which the online rates exceeded 60% in terms of both service project numbers and service volume. Nationwide customer service via new media (including Weibo, WeChat, YiChat and IM) exceeded 200 million users, which led the industry in terms of scale, with monthly service volume over 150 million times.

Network and operation support

In 2015, the Company seized opportunities and optimised our resources allocation to enhance investment in 4G network, fibre network and emerging business such as cloud computing. Through strengthening capabilities to effectively support business development and operations, core competence and customer value have been enhanced.

First, leveraging the issuance of FDD 4G license, the Company commenced “Accelerating Network Construction and Enhancing Network Quality” project for 4G. Fully leveraged centralised procurement and tower sharing, the Company effectively added 330 thousands of 4G BTS with reduced capital expenditure (an extra of 50 thousands BTS compared to the original plan), reaching a total of 510 thousands of 4G BTS. The Company deployed 10 thousands of 4G+ (LTE-A) BTS in 45 key cities, well established the 4G+ brand identity and enhanced customer perception. Currently, the Company has a 4G network coverage of all cities and developed towns and villages nationwide, with a full coverage of areas in all towns and villages in the eastern region. The network quality is comparable to the major competitors in covered areas.

Second, seized opportunity from “Broadband China” strategy and driven by market demand, the Company has accelerated fibre upgrade in urban areas and completed fibre upgrade in 170 thousands copper-network communities. Together, total fibre upgraded communities amounted to over 790 thousands, representing 85% of all copper-network communities. FTTH home passes increased by 90 million, reaching 220 million, or a coverage of 75%.

At the same time, with focus on improving and enhancing customer experience and perception, the Company has connected all segments of “device, pipe and cloud”, remarkably increasing the end-to-end speed of the broadband.

Third, the Company proactively and steadily promoted network transformation. Integrating the Company’s services, network features and data traffic direction, the Company commenced network deployment plan with IDC as the core and the construction of DCI (Data Centre Interconnect), with 15 key IDCs being interconnected in the first batch. Deploying efficiently-centralised cloud resource pools, we have enhanced resources allocation and provision capabilities, to facilitate the rapid development of cloud computing services. Learning from industry experience, the Company explored the introduction of SDN (Software Defined Network) technology and commenced network trial, in an effort to promote Internet-oriented transformation of networks.

Development measures and highlights for 2016

In 2016, the fundamental telecommunications market is increasingly saturated, leading to an intensifying competition among existing subscribers, while 4G and fibre broadband will accelerate the development in full scale. The Company will seize opportunities brought by the technology advancement and market changes to continuously deepen corporate transformation. The Company will focus on strengthening two fundamental businesses, achieving breakthrough in five emerging areas and improving six key capabilities. The Company will transform its development approaches, enhance operating capabilities and expand business scales for better corporate value. The Company will reinforce two fundamental services to maintain solid foundation, while rapidly promoting the 4G and fibre broadband subscriber scale expansion to increase subscriber penetration rate. Feed in differentiated applications, the Company will focus on promoting “4G + mobile payment” and “broadband + TV” services to drive scale development of subscriber base and increase customer loyalty. The Company will also continue to expand the new integrated development model of “fibre broadband + e-Surfing HD + 4G” to continuously increase customer value. The Company will foster new growth drivers by achieving breakthroughs in five emerging areas. First, the Company will strive to be a forerunner in “Smart Family” market by the provision of e-Surfing HD services, laying foundations for feeding in VAS and informatisation applications. Second, the Company will optimise BestPay to get ready for the deployment in Internet finance. Third, the Company will strengthen “Internet+” services and to rapidly expand into the industrial Internet market for influence. Fourth, the Company will develop cloud computing and Big Data with full efforts, exploring new revenue growth drivers. Fifth, the Company will proactively expand into the Internet-of-Things services, shifting from human-to-human communications to machine-to-human communications, and gradually towards machine-to-machine communications to explore new growth potential. The Company will also continue to optimise network resources, increase operating efficiency, improve all-rounded service capabilities, and enhance customer satisfaction for customer value realisation and sustainable corporate value growth.